The cost of wind energy fell dramatically from the 1980s through 2003, then increased for most of the remainder of the decade. Then, as the recession hit, turbine orders declined and prices with them. Meanwhile turbine technology has significantly improved, so that they are producing energy more efficiently than ever, which is the real bottom line.

Specific costs vary considerably from project to project and region to region due to differences in markets, wind resources, and economies of scale. As you work with your team of experts to plan your wind project, you must estimate these costs, especially in preparation for approaching investors and lenders. Some costs, such as the turbine purchase price, will be fairly straightforward, while other costs may be harder to estimate, such as the level of maintenance and repair your turbines will require. You will need to develop a pro forma, a financial worksheet designed to calculate project expenses and revenues, to determine the financial viability of your plan. The pro forma also allows you to determine what power purchase agreement rate you will need to negotiate in order to make your project financially viable. The pro forma is discussed in the “Financing” and “Business Models” sections of the Toolbox.

Project Economics

![]() A general rule of thumb, as of early 2013, is that commercial scale wind projects cost from $1.2 to $2.2 million per MW of nameplate capacity installed. In moderately windy areas, such as much of the midwest, look for a wind project to deliver energy for 6 cents or less per kWh.

A general rule of thumb, as of early 2013, is that commercial scale wind projects cost from $1.2 to $2.2 million per MW of nameplate capacity installed. In moderately windy areas, such as much of the midwest, look for a wind project to deliver energy for 6 cents or less per kWh.

The economics of a wind project depend on the cost of financing, when the turbine purchase agreement was executed, construction contracts, the type of machine, the location of the project, and other factors. Cost components for wind projects include wind resource assessment and site analysis expenses; the price and freight of the turbine and tower; construction expenses; permitting and interconnection studies; utility system upgrades, transformers, protection, and metering equipment; insurance; operations, warranty, maintenance, and repair; legal and consultation fees. Other factors that will impact your project economics include your financing costs, the size of your project, and taxes.

If you own or are a part owner of a commercial-scale wind project, the power purchase agreement (PPA) will be an integral part of your revenue generation. The PPA is a contract between the owner of a wind farm and a utility that sets the price of all the power that is sold. Securing a PPA is a crucial step in the planning stages of a wind project, as it obligates the agreeing entity to buy your electricity at a certain price for a certain number of years; this allows you to estimate how much revenue your project will generate. For more information about PPA negotiation and some typical terms of these agreements, see the “Power Purchase Agreement section” of this Toolbox.

Various state and federal tax incentives are available for wind projects. However, to take advantage of these benefits, you will need to thoroughly understand the eligibility requirements and structure your project accordingly. The Federal Production Tax Credit (PTC) is an important incentive, but it can be difficult for private individuals to use to its full advantage because they lack the ongoing tax liabilities needed for the incentive. Careful consideration of your personal financial situation and consultations with a tax advisor are recommended for anyone who is considering investing in a wind project. The PTC and other incentives are other major factors in your project economics and are detailed in the “Tax Incentives” section of the Toolbox.

Development and Operating Costs

Site Assessment

A comprehensive wind resource assessment for a “bankable” commercial-scale project ranges from $15,000-$50,000, depending on the size of your project and the level of detail that your bank requires for the study. Determining the capacity of your wind resource will be a primary factor in calculating potential and future revenues for your project. See the” Wind Resource Assessment” section of the Tool Box for details on conducting a thorough wind resource assessment study.

For a single turbine project, performing a soil boring, analysis, and completing a site-specific foundation design will cost between $25,000 and $45,000. As the number of turbines in the project increases, the cost per foundation will decrease.

For a single turbine project, performing a soil boring, analysis, and completing a site-specific foundation design will cost between $25,000 and $45,000. As the number of turbines in the project increases, the cost per foundation will decrease.

Land Lease

Wind projects should be sited in the windiest areas to maximize revenue from electricity sales and production incentives. Generally, this requires obtaining a lease for the land the project will be sited on as well as obtaining wind easements on adjacent land. This is to prevent other projects from being constructed too closely to your project, which would lower its production numbers. Generally, leases for megawatt-scale turbines will range from $3,000-$12,000 per turbine per year depending on the size of the turbine, the wind resource in the area, and the amount of land required for the construction. Many wind developers are paying a fixed amount per installed MW ($2,500-$4,000 or more per installed MW), which increases every year at either a fixed percentage or at the Consumer Price Index rate of increase. Landowner payments can also be structured as a percentage of the production revenue from the project. Easement costs for a project will vary. For more detailed information about costs and lease and easement stipulations see the “Leases and Easements” section of this Toolbox.

Permits

Your project will need to perform archeological, environmental impact, and other studies before permits to build are issued. Your local or state permitting agency may also require other studies and fees. Common permits are building, conditional/ special use, FAA, and access road. Your local and/or state zoning authority will be able to help you determine what permits your project will need to obtain. For more information about what agencies to contact, visit the “Zoning and Permitting” section of the Toolbox. Legal costs in permitting can get expensive for projects in areas where possible litigation might occur from parties affected by the project. Often a building permit fee is based on total project cost and can amount to $5,000-$10,000 per turbine. The cost to hire consultants and complete the required studies can range from $5,000-$50,000 for a single turbine project.

Connectivity

![]() It is imperative to research the interconnection process early in the planning phase because the process can be very time consuming and the costs of interconnecting can be prohibitive for a project.

It is imperative to research the interconnection process early in the planning phase because the process can be very time consuming and the costs of interconnecting can be prohibitive for a project.

Interconnection studies for a project can cost anywhere from $5,000-$150,000 or more, depending on the size of the project and where you propose to interconnect. Three-phase lines are required for large generators, but you cannot assume that any three-phase line can carry the power from your turbines. You may incur significant unanticipated costs if the power line near your site does not have the capacity to handle more electricity. In other words, you need to check whether nearby power lines are “full.” Transmission lines are expensive to build and difficult to site.

If there is available capacity on the transmission lines near your site, you will likely need to build feeder lines from your wind farm to the transmission lines. Feeder lines usually cost $70,000- $90,000 per mile and operate at a higher voltage (typically 12 kV, 24 kV or 34.5 kV) than what the generator creates, requiring a step-up transformer at the base of each wind turbine. The cost of the transformer ranges from $15,000-$50,000 for each turbine. Some wind turbines and transformers come as a package. Discuss this detail with the turbine manufacturer. At the point the electricity is transferred from your ownership to the utility’s (the interconnect point), you will be responsible for paying for all the equipment that the utility requires to make a safe and stable interconnect. This equipment includes some or all of the following:

- Switches that can disconnect your project

- Relays, breakers, and fuses to protect the power system, should there be an electrical fault

- Metering to tell the utility how much you have generated and added to their system

- Various other electrical structures/devices

- Electrical wire, which can often be the most expensive part of the electrical connection. With the high cost of copper and aluminum, the wires running down the tower alone can cost more than $20,000 for a larger generator.

The interconnection study will outline what impact your project will have on the power system. The results of this study may require that your project pay for significant system upgrades to mitigate these issues. Interconnection upgrades can cost in the thousands to hundreds of thousands of dollars. You should work with an expert through the interconnection process to make sure that the utility is not adding unnecessary additional costs to the proposed upgrades, making it difficult for you to develop the project.If a smaller project can interconnect onto a distribution line (usually less than 25kV), then it can benefit from a lower cost interconnection without the necessary substation elements needed for connecting to power lines. Distribution lines are the lines that bring the energy to the customer, whereas transmission lines are for transmitting electricity from point to point using higher voltages to minimize line losses.

![]() A 6 MW project connecting to a 69kV transmission line will require building an interconnection substation with costs in excess of $1million dollars. The same 6 MW connected to a distribution system can cost one-fourth this amount in interconnect fees.

A 6 MW project connecting to a 69kV transmission line will require building an interconnection substation with costs in excess of $1million dollars. The same 6 MW connected to a distribution system can cost one-fourth this amount in interconnect fees.

A new dedicated transmission line for your project will cost in excess of $200,000 per mile. The utility may also make recommendations for additional system features that are not required and may or may not be beneficial to your project. For example, the utility might advise you to put in a “dual line feed” to avoid them curtailing your turbine for those few days a year they need to do line maintenance. The dual line is a second, redundant line that allows your project to generate power even if the first line is taken out of service. Evaluating the cost effectiveness of a dual line feed will be part of your economic analysis.

Turbine and Tower

The turbine and tower are the largest expenses associated with developing a project. Current commercial turbines range in price from $1.1 to $1.7 million per MW. This cost will vary depending on the size of the project, turbine manufacturer and model, the distance and method used to transport the turbine and tower to the site, and other factors. This cost will normally include supervision from the manufacturer at the job site and final commissioning of the project. You will need to contact turbine manufacturers for current quotes to find out the cost of a particular turbine and tower, and whether or not they will have turbines available when you are ready to make a down payment. Turbine availability is a significant hurdle today since supply has fallen short of increasing demand.

Installation Costs

Installation costs are all the expenses required to construct and get a turbine up and running once it arrives. Most owners hire experienced contractors to prepare the site and install the turbines. Connecting the turbine to the grid is often done through a team effort involving the contractor, representatives from the turbine manufacturer, and engineers from the utility company that owns the power lines. Contractors who install turbines should be able to give a comprehensive cost estimate for a job that includes the following major items: access roads, foundations, wiring to the tower bases, and turbine erection.

Access roads. If required, an access road typically is a 15’ wide gravel road at grade. Budget for at least $25 per foot, plus additional money for road turnouts, culverts and a crane pad. These costs could add up to $35,000 or more for a quarter-mile access road built over a farm field to the turbine location.

Foundation. This cost depends on the height of your tower and weight of the generator assembly and rotor, plus the soil conditions at your site. A turbine foundation is very large: 8-20 truckloads of concrete, with costs ranging from $100,000 to $250,000 including soil boring and engineering design.

Wiring to turbine base. This includes installation of a pad mount transformer at the turbine base if required, underground wiring on the property, electric poles to carry the power to the utility line if required, and installation of all these components. The cost range is $40,000 to $200,000 or more, should you require several miles of feeder line.

Turbine erection. The major cost in the erection process is the rental of a crane. A 300-foot crane with the necessary 400- plus ton capacity can cost $80,000 or more for a single day. Should you have weather delays or other difficulties, the rental charge of the crane might add 10% per day to construction costs. A comprehensive price estimate from a qualified installation company will likely be in the range of $100,000 to $150,000 per MW.

Commissioning Costs

Turbine commissioning costs are usually included in the price the turbine manufacturer or distributor charges when a machine is ordered. Commissioning is the process of connecting the turbine to the transmission lines and making sure it is working correctly. The main components of commissioning are final wiring, setting parameters, checking operational safety, and verifying the successful generation of power as shown in the manufacturer’s instructions.

Operating Costs

Once your project is up in the air and spinning there are periodic and annual expenses that you will need to account for. Some of these expenses will happen every year such as preventative maintenance of the machine(s). Other expenses may happen less frequently or sporadically such as replacement of parts that have worn out. The list below is not comprehensive of everything that your project may have to plan for but it contains ones that projects most commonly account for in their business plan to start from. The best way to understand what is appropriate for your project is to understand the risks associated with owning a wind project and ways to mitigate those risks by talking to people who own and operate projects using the same equipment within your region and learning from their experience.

Operation and maintenance (O&M). O&M management is critical to successful ownership of a turbine. Owners can choose to do most of the O&M themselves, as long as they are trained by the company technicians who perform the turbine commissioning. Third party and turbine manufacturers also offer turbine O&M services. These services typically range from $20,000 to $50,000 per year for each turbine. The location, size and turbine model of your project will all affect the O&M costs. O&M companies have different service packages that they offer based on your project’s needs.

O&M includes monitoring the turbine 24 hours a day, seven days a week. You will need someone on call at all times to solve the many minor turbine controller issues that arise (and shut down or start up your machine). Modern large wind turbines are often warranted to run at 95-97% availability, which is achieved partly by the quality of the machine and partly by the quick response of the O&M team.

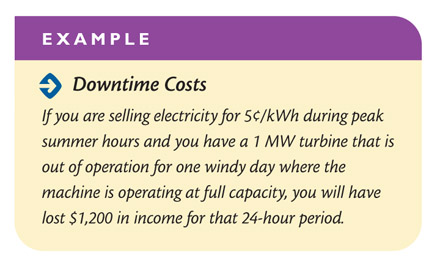

![]() Down time is lost money. You will likely make most of your profit on the 30-60 days per year that the wind blows over 30 mph at hub height and the turbine generates at close to peak output all day. If your turbine is shut down while waiting for maintenance during several of these days, you could lose significant income.

Down time is lost money. You will likely make most of your profit on the 30-60 days per year that the wind blows over 30 mph at hub height and the turbine generates at close to peak output all day. If your turbine is shut down while waiting for maintenance during several of these days, you could lose significant income.

Warranty. A machine warranty will typically run between $20,000 to $40,000 per year per turbine depending upon the turbine manufacturer, size of the project, and turbine model. A typical warranty lasts for two years with an option to extend the warranty up to five years. Typically, extending the warranty on equipment is a good investment, if available, and you should incorporate this into your business plan.

Insurance. Insurance costs range from $8,000-$15,000 per year for each turbine. This cost will increase after the warranty on the machine is over and the likelihood of equipment failure increases in the later years of the project. Several insurers with experience insuring wind machines can provide valuable input on your project costs by outlining the various scenarios you need to protect yourself against. Insurance is peace of mind for the lending institution. Before you approach your lending institution you should get several estimates for insurance costs for your project to show your lender that you have done your homework. There are generally 6 types of insurance your project might need to require:

- General liability

- Property

- Business income (loss of profit)

- Equipment protection (from breakdown)

- Manufacturer’s warranty (usually 2 years with the potential to extend out to 5)

- Insurance should the Production Tax Credit expire if your project is delayed

Insurance is typically included in the annual operation and maintenance expenses budgeted at 2-3% of capital costs. Consult with several insurance providers to determine what actual costs are associated with these types of coverage. Keep in mind there is a deductible (typically $20,000 for equipment and 10-20 days for business interruption insurance period), so reserve money is necessary for emergency repairs. You should budget to have cash on hand to pay for repairs because waiting for the insurance company to pay out before making the repairs means lengthy delays and additional losses of revenue. A list of wind insurance providers is included at the end of this section.

Insurance is typically included in the annual operation and maintenance expenses budgeted at 2-3% of capital costs. Consult with several insurance providers to determine what actual costs are associated with these types of coverage. Keep in mind there is a deductible (typically $20,000 for equipment and 10-20 days for business interruption insurance period), so reserve money is necessary for emergency repairs. You should budget to have cash on hand to pay for repairs because waiting for the insurance company to pay out before making the repairs means lengthy delays and additional losses of revenue. A list of wind insurance providers is included at the end of this section.

Administrative and legal costs. These must be addressed as you plan a commercial scale wind project. At a minimum, you’ll want to hire an accountant to prepare your taxes, but you will likely need other professional services to deal with contract issues, billing, insurance settlements, and whatever service issues arise. A developer typically budgets $6,000- $10,000 per year per turbine for administrative and legal costs. Do not assume that you can put up a large turbine and just sit on the porch enjoying the income. There will be plenty to do, and you need to budget yourself or another person 5 hours or more every week to address issues relating to the project.

Decommissioning

Decommissioning costs depend a great deal on permit requirements and turbine and site-specific issues such as how deep the foundations are poured. Wind developers rarely seek bids for the cost to decommission a project during the planning stages, but rather assume that the salvage value of the turbines will cover those expenses when the time comes.

Many projects currently under development in Minnesota are setting up decommissioning funds that are accessible by the property owner should the project fail. Generally the size of this fund is around $25,000 per turbine.

One way to estimate decommissioning costs is to assume that the future scrap value of the turbines will be 5-10% of the initial equipment cost, or to guess what the value of steel and copper and the other metals in the turbine would be in 20 years. This is either put into the project pro forma in year 1 as an up-front “bond,” in year 20 as an expected cost, or spread over time such as during years 11-20.

Many projects are not decommissioned, but are repowered. If a site is proven to have good wind resources, in many instances it makes more sense to replace turbines as needed rather than remove the entire facility. A decommissioning fund could be directed to repowering at the appropriate time. The landowners and local residents may feel more comfortable with a decommissioning fund in a project plan that makes sure the equipment is dealt with in a timely manner at the end of its useful life.