In order to be financially competitive, most wind projects need to take advantage of federal and, where available, state tax incentives. It is critical to understand the role and mechanics of tax incentives while developing a commercial-scale community wind project because these incentives can represent one-half to two thirds of the total revenue stream over the first 10 years of operation due to the Federal Production Tax Credit (PTC) and Modified Accelerated Cost-Recovery System (MACRS) or other type of depreciation that can be applied to wind energy assets.You will need to consult a tax professional in the early stages of project planning to ensure that your financial projections are valid and accurately take into account the project’s tax burden and benefits.

Different tax incentives apply to different projects based on location, project size, and other tax liability delimiters, so you will need to explore what is currently available and applicable to your project.

This section of the Toolbox provides information on currently available (as of spring 2007) tax incentives that have significantly contributed to wind energy development. It also explains mechanisms for utilizing them to improve your project’s bottom line. The application of many of these tax benefits is also outlined in the “Business Models”,”Financing”, and “Project Calculator” sections of the Community Wind Toolbox. The role of the tax consultant is covered in further detail in the Project Management section.

- Federal Tax Incentives

- State Level Tax Incentives

- Taxation of Wind Energy Property

- Additional Resources for Taxes and other Incentives

Federal Tax Incentives

The Federal Production Tax Credit

The Federal Production Tax Credit (PTC) is a 2.3¢/kWh credit (adjusted annually for inflation) that projects can earn during the first ten years of production. This credit, found in section 45 of the IRS tax code, has been the single largest driver of wind energy development in the United States to date, despite its continual need for renewal by Congress. Currently, the PTC is extended through the end of 2013, and advocates are pushing for further extension.

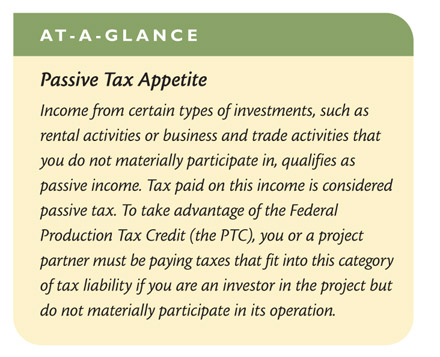

In order to qualify, an individual taxpayer must own the wind project and either materially participate (see Internal Revenue Service Publication 925) in the project or have tax liability from passive income that the PTCs can be credited against (United States Government Accountability Office, Renewable Energy: Wind Power’s Contribution to Electric Power Generation and Impact on Farms and Rural Communities, 42 (September 2004)). For individuals who do not materially participate, they must receive enough passive income (such as rental income or income from businesses in which they participate only as an investor) to produce a tax liability against which the credit can be applied.

In order to qualify, an individual taxpayer must own the wind project and either materially participate (see Internal Revenue Service Publication 925) in the project or have tax liability from passive income that the PTCs can be credited against (United States Government Accountability Office, Renewable Energy: Wind Power’s Contribution to Electric Power Generation and Impact on Farms and Rural Communities, 42 (September 2004)). For individuals who do not materially participate, they must receive enough passive income (such as rental income or income from businesses in which they participate only as an investor) to produce a tax liability against which the credit can be applied.

Fully utilizing the PTC is a difficult hurdle for most farmers (GAO, 41). If a farmer, rancher, or landowner does not materially participate in a wind project, the credits cannot be applied against the farmer’s income from active farming businesses, wage income, or interest and dividend income. Even when a farmer materially participates, the value of the tax credit usually exceeds an individual’s tax liability from the wind project plus any other sources.

Community wind developers need to be aware that the PTC amount for an individual project may be reduced by the use of other federal or state funding, such as U.S. Department of Agriculture Farm Bill grants.

Community wind developers need to be aware that the PTC amount for an individual project may be reduced by the use of other federal or state funding, such as U.S. Department of Agriculture Farm Bill grants.

![]() For more information on PTC utilization and its interaction with other incentives see writings by Mark Bolinger of Lawrence Berkeley National Laboratory and resources such as the “Publication 925: Passive Activity and At-Risk Rules” by the Department of Treasury – Internal Revenue Service.

For more information on PTC utilization and its interaction with other incentives see writings by Mark Bolinger of Lawrence Berkeley National Laboratory and resources such as the “Publication 925: Passive Activity and At-Risk Rules” by the Department of Treasury – Internal Revenue Service.

PTC & the “Flip”. Many locally owned, for-profit entities are eligible for the PTC, but their modest tax appetites limit the amount of the tax credit they can utilize. The “Minnesota Flip” is a business model designed to help local wind project owners with minimal tax credit appetite pair up with a larger entity that has a more substantial tax burden. Because the tax credits available to project owners are typically proportional to their level of ownership in the project, the tax-motivated entity is the majority owner in the first ten years of production and often pays a “management fee” to the local owner in lieu of power sales revenue. Once the tax incentive period ends after year 10, the majority ownership of the project “flips” to the local owner, and the tax-motivated investor takes a minority share in the project. For more information, see the “The Minnesota Flip” section of the Toolbox.

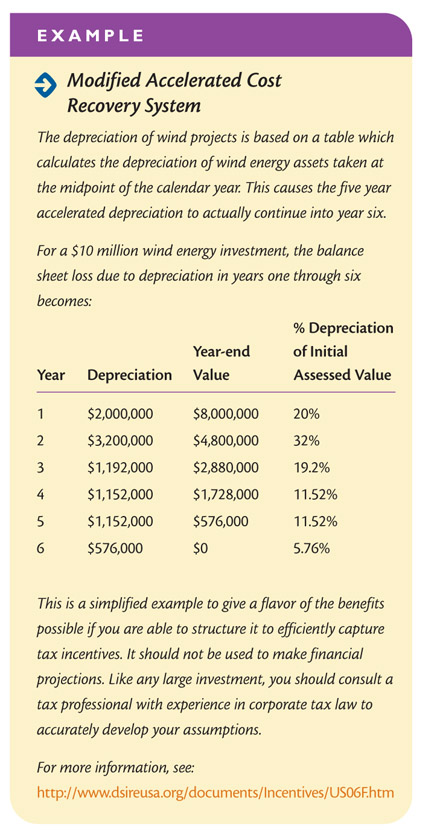

Modified Accelerated Cost-Recovery System (MACRS or Accelerated Depreciation)

With accelerated depreciation, wind projects can write off the value of their equipment on their financial balance sheets over 5 years rather than the typical 20-year projected lifetime of a project. While accelerated depreciation is available to all wind energy projects, the level at which a project can take advantage of this program is, like the PTC, limited to the project owners’ applicable tax burden. Community wind project owners that typically have a small tax burden may not be able to take advantage of accelerated depreciation without taking on a tax-motivated investor with a sufficient tax appetite to claim the entire incentive.

Alternative Minimum Tax

![]() The Alternative Minimum Tax (AMT) is confounding for many Americans who find themselves suddenly beholden to the IRS for taxes they thought they didn’t owe. AMT can be thought of as a different tax system with different rules and deductions; taxpayers must compute their taxes under both the regular tax and AMT rules and then pay the greater of the two.

The Alternative Minimum Tax (AMT) is confounding for many Americans who find themselves suddenly beholden to the IRS for taxes they thought they didn’t owe. AMT can be thought of as a different tax system with different rules and deductions; taxpayers must compute their taxes under both the regular tax and AMT rules and then pay the greater of the two.

The purpose of the AMT is to prevent those in the highest tax bracket from getting by from year to year tax free. A consequence is that many unsuspecting taxpayers who make less than $100,000 a year with certain kinds of investments and deductions end up having to pay AMT. Investing in certain types of businesses can trigger the AMT.

The only way to determine if your investment in a wind project will trigger the AMT is to work with a tax professional to fill out IRS Form 6251. If it turns out that your AMT is higher than what you would pay normally, then your investment in a wind project will limit your ability to utilize the PTC and other tax credits available to wind energy investors. Form 6251 can be found on the IRS’s website by searching for the form by number.

State Level Tax Incentives

The source for the most current information on state incentives is the Database of State Incentives for Renewable Energy (DSIRE).

Sales Tax Exemption

Several states have exempted sales tax on equipment, infrastructure, supplies and replacement parts for wind systems.

![]() To see if your state has an exemption on sales tax on wind energy systems visit DSIRE, the Database of State Incentives for Renewable Energy.

To see if your state has an exemption on sales tax on wind energy systems visit DSIRE, the Database of State Incentives for Renewable Energy.

Taxation of wind energy property

Property Taxes and Payments-In-Lieu-of-Taxes (PILOT). Several states and localities have exempted renewable energy systems from property tax in order to promote development. This has a favorable impact on the economics of a project because the addition of a several million dollar wind project to a parcel of land could send the assessed property value through the roof, greatly increasing the tax burden to the landowner or project developer.

Many communities in areas where wind development is prevalent and renewable energy systems are exempt from property taxes negotiate payments (PILOTs) between the local taxing authority and the project. These payments compensate for excessive use of infrastructure in the area while developing the project and allow the local community to benefit from wind energy development. Property taxes and PILOTs contribute a great deal to the tax revenue of many windy rural areas and aid in the development of new schools, community centers, and other local programs. Project developers opt to enter into PILOT contracts in order to be good neighbors to the community, while other areas may require these payments before local authorities grant permission to build.

The New York State Energy Research & Development Authority (NYSERDA) has developed detailed information on property tax exemptions and payments-in-lieu-of-taxes as part of their Wind Energy Tool Kit. Much of the information is specific to the state of New York, but the descriptions of the different types of payments may be transferable to other parts of the country.

![]() For more information see the online resources from New York State Energy Research and Development Authority (NYSERDA)

For more information see the online resources from New York State Energy Research and Development Authority (NYSERDA)

Taxation based on production. Some states tax energy facilities based on the energy produced. Minnesota, for example, has a tiered tax structure on energy production. The tax rate is determined by the size of the project.

- Large-Scale Wind Energy Conversion Systems: Projects with installed capacities of 12 MW or greater will make payments of 0.12¢/kWh.

- Medium-Scale Wind Energy Conversion Systems: Projects with installed capacities between 2 and 12 MW will make payments of 0.036¢/kWh.

- Small-Scale Wind Energy Conversion Systems: Projects with installed capacities between 250 kW and 2 MW will make payments of 0.012¢/kWh.

- Systems with installed capacities less than 250 kW are exempt from the production tax.

The tax structure was set up this way to level the tax playing field between small projects and large projects, as well as to promote smaller locally-owned projects by not placing undue burden on them. It is important to consult with the local tax authority to determine how the project will be taxed.